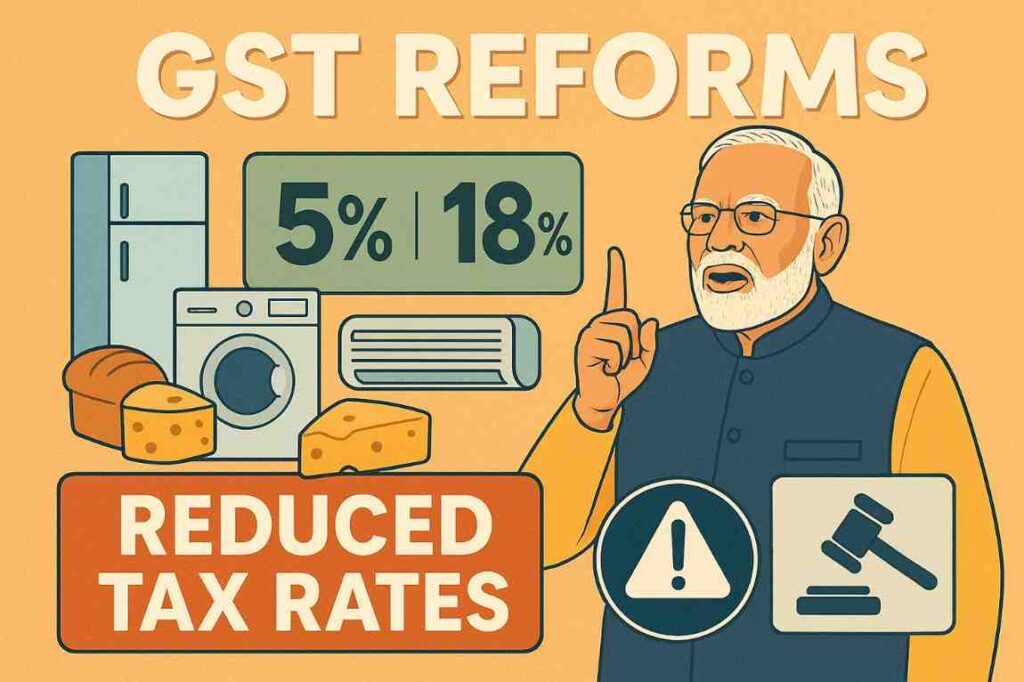

The Indian government is preparing to introduce major GST reforms before Diwali this year, aiming to ease the tax burden for common citizens, small entrepreneurs, and MSMEs. Prime Minister Narendra Modi has called these upcoming reforms a “Diwali gift” that will make goods and services more affordable, increase consumption, and support economic growth.

The planned changes are among the most significant updates to the Goods and Services Tax (GST) since its introduction eight years ago. By restructuring tax slabs, reducing rates on essential and aspirational goods, and simplifying compliance, these reforms are expected to benefit both businesses and consumers.

Lower GST Rates on Essential and Aspirational Goods

The government is considering reducing GST rates on several goods, including refrigerators, air conditioners, packaged food items like fruit juices, butter, cheese, condensed milk, nuts, dates, sausages, and even critical medical supplies such as oxygen, gauze, bandages, and diagnostic kits.

By cutting taxes on these products, the aim is to:

- Make daily-use and aspirational items more affordable.

- Boost consumer demand during the festive season.

- Encourage higher sales for manufacturers and retailers.

The Ministry of Finance has emphasized that the GST reforms will improve affordability and ensure a wider section of the population has access to both essential and luxury products.

Moving From Four Slabs to Two

Currently, GST is divided into multiple slabs—5%, 12%, 18%, and 28%. The new proposal aims to simplify this structure into just two major slabs—5% and 18%—with an additional special rate of 40% for sin and demerit goods.

Key highlights of the proposal:

- 99% of goods in the 12% slab will move to the 5% slab.

- 90% of goods in the 28% slab will be shifted to the 18% slab.

- Common-use items will remain in the 0% or 5% category.

- Precious metals like gold, gems, and diamonds will keep their current rates below 5%.

This shift will make the tax system easier for businesses to understand and follow, reducing confusion and disputes over classification.

End of Compensation Cess and Introduction of 40% Special Rate

At present, the top GST slab is 28%, along with a compensation cess on certain goods such as luxury cars, tobacco, cigarettes, pan masala, and air conditioners. This cess ranges anywhere from 1% to 290%. However, with the compensation loans nearly repaid, the cess is expected to end by November–December this year.

The new plan proposes:

- A uniform 40% tax rate for around seven sin or demerit goods.

- Moving items like cement and large household appliances to the 18% slab.

- Keeping the total tax incidence on tobacco and similar products unchanged.

For example, tobacco will continue to face the current tax burden of 88%, ensuring no reduction in taxation on harmful goods. Similarly, online gaming—currently taxed at 28%—is likely to move to the 40% bracket.

Balancing Revenue and Consumption

While lower tax rates could reduce revenue in the short term, the government believes that these GST reforms will ultimately increase compliance and consumption, balancing the losses. This is based on the principle of the Laffer Curve, which suggests that lower tax rates often lead to higher overall revenue by boosting demand and reducing tax evasion.

A senior official explained that rationalising tax slabs will not only simplify compliance but also expand the GST base, bringing more taxpayers into the system.

Cooperative Federalism: Centre and States to Decide Together

The proposal for GST rate rationalisation has already been sent to the Group of Ministers (GoM) formed by the GST Council. The Council, which includes representatives from both the Centre and states, is expected to meet in the coming months to discuss the changes in detail.

Since lowering tax rates may impact state revenues, discussions are expected to be thorough. Some states may resist these reforms due to fiscal concerns, and the final decision might even go to voting within the Council.

The Finance Ministry has assured that it will work with states in the spirit of cooperative federalism to build consensus. The goal is to ensure that these GST reforms are implemented smoothly and on time.

Benefits for Businesses and Consumers

The reforms are not just about reducing tax rates—they aim to simplify the entire GST framework and make it more business-friendly.

Expected benefits include:

- Reduced disputes over classification of goods.

- Correction of inverted duty structures in sectors like textiles.

- Greater stability in tax rates, allowing businesses to plan better.

- Improved ease of doing business with a simpler tax system.

By reducing compliance hassles, businesses—especially small and medium enterprises—will save time and money. On the consumer side, lower prices will lead to increased demand, benefitting the entire economy.

Previous Discussions on GST Rate Rationalisation

The idea of rationalising GST rates is not new. The GST Council had first taken up the issue in 2021 during its 45th meeting in Lucknow. At that time, it discussed correcting inverted duty structures and simplifying the slab system. Changes were introduced in sectors like textiles and footwear from January 2022.

Over the years, the complex structure of GST with multiple rates has been criticized. However, a single rate was rejected by former Finance Minister Arun Jaitley, who explained that different products require different tax treatments. For example, taxing food items and luxury cars at the same rate would not be fair.

Still, Jaitley had suggested that India should eventually move to a three-slab structure—0%, 5%, and a standard rate between 12% and 18%, with higher taxes only for luxury and sin goods. The current proposal appears to be in line with that vision.

Challenges Ahead

While the benefits of these GST reforms are clear, challenges remain:

- State resistance due to potential revenue losses.

- Careful review of nearly 1,500 categories of goods and services.

- Need for consensus within the GST Council to implement changes smoothly.

According to government data for 2023–24, around 70–75% of GST revenue came from the 18% slab. This means any changes to slabs must be carefully managed to avoid major revenue disruptions.

Looking Forward

The upcoming GST reforms are being seen as a landmark moment in India’s taxation history. If implemented, they could simplify the tax system, encourage consumption, and strengthen the economy.

The government hopes to roll out these changes before Diwali, ensuring that businesses, households, and the overall economy can benefit from lower taxes during the festive season.

With the Finance Ministry working closely with states, the stage is set for the next generation of GST reforms—bringing India closer to a simpler, fairer, and more efficient tax system.