Table of Contents

Introduction

Gold has always held a special place in India’s culture, finances, and emotions. It is not merely a metal — it acts as a safe haven, a long-term investment, and a store of value for millions of Indian households. Naturally, whenever gold rate fluctuates sharply, people want to know: Will the gold rate go down in the coming days?

In this article, we will explore key drivers behind the gold rate movements, examine current signals, weigh expert opinions, and finally offer a balanced outlook on whether gold rate is likely to decrease soon in India. I’ll keep the language simple, clear, and informative.

Why Gold Rate Moves: Key Factors to Know

Before forecasting, it’s important to see what causes gold rate (i.e. the price of gold) to rise or fall. Here are the main drivers:

1. US Dollar Strength and Exchange Rate

Gold and the US dollar often move in opposite directions. When the US dollar strengthens, gold becomes more expensive in other currencies (like Indian rupee), reducing demand. Conversely, if the dollar weakens, gold tends to gain.

Since India imports most of its gold, rupee-dollar exchange plays a big role. A weak rupee pushes up domestic gold rate, while a stronger rupee may push it down.

2. Global Interest Rates and Central Bank Policy

Gold yields no interest, so when interest rates (especially in the US) are high, investors may prefer interest-bearing instruments. If central banks cut rates or signal dovish stance, gold becomes more attractive.

For example, expectations of US Federal Reserve cutting rates can support gold.

3. Inflation and Economic Uncertainty

When inflation is high or uncertain — or in times of economic stress — investors often flee to safe-haven assets like gold. Gold is seen as a hedge against inflation, currency risk, or geopolitical crisis.

4. Demand from India (Festivals, Weddings)

In India, a large part of gold demand comes from jewelry purchases during festival seasons and weddings. High demand in these periods can push the gold rate upward. During lean demand periods, prices may soften.

5. Supply, Imports, and Scrap Gold (Recycling)

If supply is constrained — less gold coming from mines or imports — the gold rate may stay firm or rise. Scrap gold (jewellery or old gold sold by people) can add supply, but if people expect prices to go higher, they may hold instead of selling.

6. Central Bank Purchases

Central banks across the world buy gold to diversify reserves. If these purchases increase, they push up global gold demand and prices. If they slow down, that could ease pressure on gold rate.

Current Situation: Where Do We Stand?

To see where gold rate might go, let us first review the recent trends and signals.

Recent Surge in Gold Rate

- In India, gold prices have hit record highs. On September 23, 2025, prices jumped sharply.

- The rise is driven by global demand for gold as a safe-haven and weakening of the Indian rupee.

- Premiums in India (the extra cost over global benchmark due to local demand) have reached a 10-month high due to festive demand.

- Scrap supply has not risen sufficiently, as many holders expect further gains and prefer to hold onto gold rather than selling.

So, the current momentum is strongly upward, and many market participants are expecting this rally to continue.

Contrarian Signals: Warnings and Pullback Risks

- Some analysts caution that gold may be overextended. They note that past cycles have seen strong peaks followed by prolonged corrections. The Economic Times

- Global interest rate policy remains a risk. If central banks (especially the US Fed) decide to keep rates high for longer, that could dampen gold demand.

- Also, reduced demand for jewelry may set in as prices become unaffordable for many buyers.

Forecasts by Experts

- Analysts at Mirae Asset / Sharekhan believe gold will maintain a positive bias over the coming months, with dips seen as buying opportunities. The Times of India

- Futures markets show gold futures for December rising, supported by expectations of rate cuts. The Economic Times

- On the other hand, some believe gold is near its peak and further upside is limited—suggesting a possible reversal ahead. The Economic Times

- According to BankBazaar, some projections expect gold rates to fall in coming quarters of 2025, citing factors like a stronger US dollar, reduced demand, and global economic caution. BankBazaar

Will Gold Rate Decrease in the Coming Days? — A Balanced View

Given the drivers and current tensions, what is likely to happen to gold rate in India in the short to medium term (a few days to a few weeks)? Let’s weigh the evidence:

Arguments in Favor of a Decrease

- Profit Booking / Short-Term Pullback

After sharp gains, some investors may lock in profits, causing a temporary downward move. - Stronger US Dollar / Hawkish Fed Stance

If the US dollar strengthens or the Fed signals a reluctance to cut rates, gold may come under pressure. - Lower Jewelry Demand

As gold becomes more expensive, ordinary buyers may step back, reducing demand and curbing further upward pressure. - Increased Scrap Selling

If holders believe prices may drop, they may sell scrap gold, increasing supply and pushing rate downward.

Arguments Against a Decrease

- Festive & Wedding Season Demand

In India, upcoming festivals and weddings often drive strong demand, supporting gold prices. - Risk Sentiment / Safe-Haven Demand

Any global turmoil, inflation spikes, or geopolitical tensions will push more money into gold. - Expectations of Rate Cuts

Market participants are pricing in rate cuts in the US later in 2025, which supports gold. - Tight Supply, Low Scrap Flow

Current low scrap supply suggests limited downside. Many holders are reluctant to sell. Reuters+1

Given this tug of war, a full-scale drop in gold rate seems unlikely in the very near term. But a mild correction or sideways movement is quite probable as markets digest recent gains and re-test support levels.

Scenario-wise Outlook: What Could Happen

Below is a scenario-based outlook on how gold rate might behave in near future:

| Scenario | What Might Happen | Likelihood / Notes |

|---|---|---|

| Mild Correction / Pullback | Gold rate falls slightly (say 1–3 %) from recent highs, then stabilizes | Quite possible—due to profit booking and short-term overbought conditions |

| Sideways / Consolidation | Gold rate stays in a narrow range (little upward or downward movement) | Likely if buyers and sellers balance out |

| Strong Drop | Gold rate drops significantly (5 % or more) | Less likely unless there’s a major negative catalyst (strong dollar, hawkish Fed) |

| Continuation Upwards | Gold rate continues rally | Also possible if global conditions stay favorable (rate cuts, inflation concerns, safe-haven demand) |

From current signals, the mild correction or sideways scenario seems the more realistic near-term possibility.

What Levels to Watch (Support & Resistance)

To anticipate where gold rate may head, observe these levels:

- Support Levels (if decline occurs):

Watch for levels near ₹1,08,000 to ₹1,10,000 per 10 grams (for 24k/22k) as potential support zones.

A fall below such support might trigger further downside. - Resistance / Ceiling Levels:

If gold continues upward, ₹1,18,000 – ₹1,20,000 per 10 grams may act as a near-term resistance.

Beyond that, overcoming those could require fresh catalysts.

Analysts suggest any dips above support zones may be used as buying opportunities. The Times of India

What Should Investors / Buyers Do?

Given the mixed signals, here are some practical tips:

1. Avoid Trying to Time the Exact Top or Bottom

It’s hard to predict exactly when gold will peak or dip. Trying to buy or sell at perfect timing often leads to mistakes.

2. Use Corrections as Entry Opportunities

If gold rate pulls back modestly, it may offer a chance to accumulate for long-term holding.

3. Keep a Margin / Stop-Loss

If you invest or buy gold, maintain some buffer in your cost basis or set mental stop-loss levels, in case rate moves against you.

4. Diversify

Don’t rely solely on gold. Diversify across assets — stocks, bonds, real estate, etc.

5. Monitor Key Indicators

Keep an eye on:

- US Federal Reserve announcements

- US dollar index

- Global inflation data

- Geopolitical events

- Indian import policies and duties

- Domestic demand during festival periods

These will give cues on direction.

Final Verdict: Will Gold Rate Decrease Soon?

In summary:

- At present, gold rate is in a bullish phase, supported by rupee weakness, global safe-haven demand, limited scrap supply, and upcoming festival demand in India.

- But after steep gains, a short-term mild correction or sideways movement is more plausible than a sharp drop.

- A significant decrease would likely need a strong catalyst: sustained US dollar uptick, hawkish monetary policy, or a collapse in demand.

- Over a somewhat longer time frame (weeks to a few months), if global economic conditions improve and inflation slows, we could see downward pressure on gold.

So, yes, it is possible for the gold rate to dip slightly in the coming days, but a steep or sustained fall seems unlikely unless a big shock arrives.

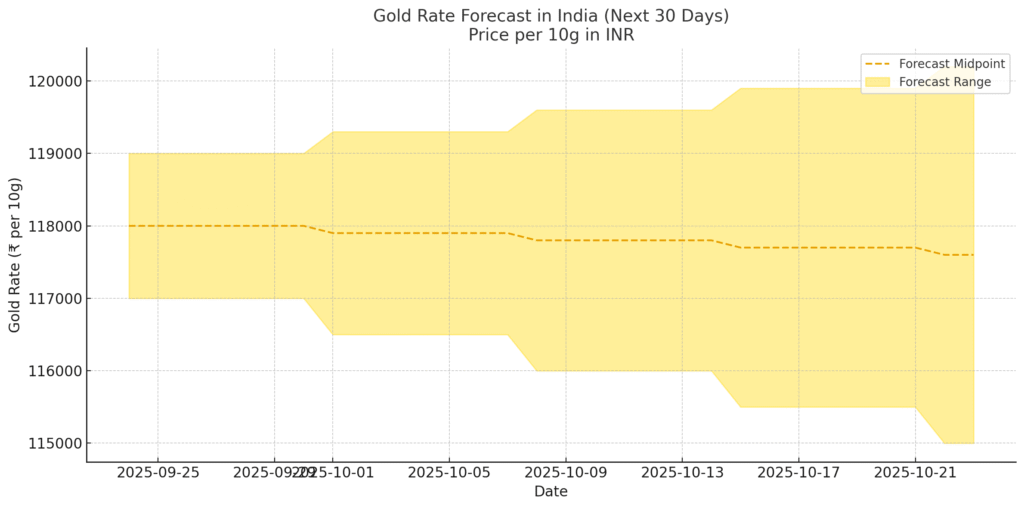

Here’s a 30-day forecast chart for gold rate in India (per 10g).

It shows a sideways-to-mild correction trend, with most movement expected between ₹1,17,000 and ₹1,19,500 per 10g, and only limited chances of a steep fall.

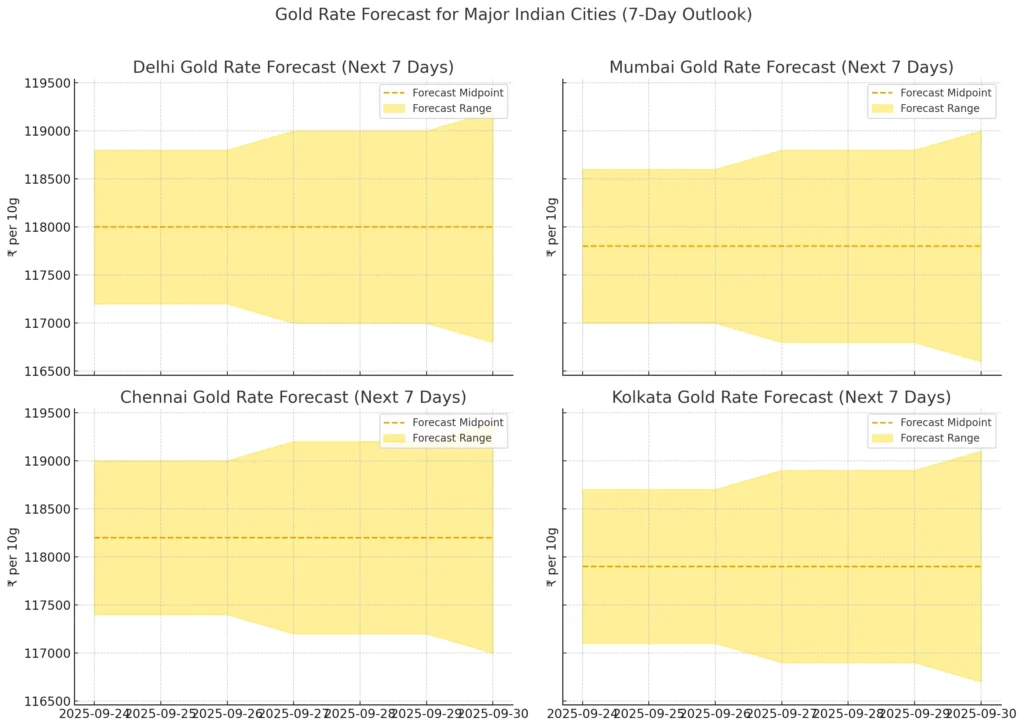

Here are 7-day gold rate forecasts for Delhi, Mumbai, Chennai, and Kolkata.

Each chart shows a forecast range (shaded) and a midpoint trend (dashed). Overall, all cities follow a similar sideways-to-slight-correction movement, with city-specific small differences due to local demand and premiums.

Disclaimer: The gold rate predictions and forecasts mentioned in this article are based on current market trends, expert opinions, and publicly available information. They are not guaranteed outcomes and should not be treated as financial advice. Gold prices can change quickly due to global and local factors. Readers are advised to do their own research or consult a certified financial advisor before making any investment or purchase decisions.